‘‘Only those who are ideologically opposed to military programs think of defence budget as the first and best place to get resources for social welfare needs’’. -Herman Kahn.

Introduction

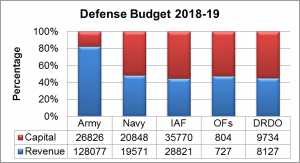

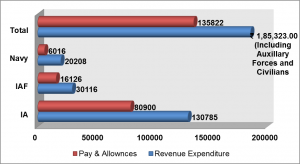

Revenue vs Capital Expenditure and how rising manpower cost is adversely affecting defence modernisation and operational preparedness of the armed forces, is discussed often, especially in run up to the presentation of annual budget. A perception has been generated as if, armed forces are expending the entire allocation on pay, allowances and maintenance of forces and not on creating any assets. The Govt, as also the Ministry of Defence (MoD) has been highlighting the imbalance between Capital and Revenue Expenditure and emphasising that the defence forces need to improve this ratio. Army is especially ‘pillared’ on this account because our Revenue and Capital Expenditure ratio stands at 83 : 17 as compared to Navy whose ratio is 52 : 48[1], while that of Air Force is 55 : 45. While the figures can’t be disputed, the rationale for the same needs to be put across to the Govt officials as well as the academia and general public to correct the misplaced perception.

Army, Air Force and Navy operate in completely different environment and therefore, require diverse resources to meet their operational requirements. Comparison between the three services and the categorisation of ‘What is Revenue’ for Army suffer from serious lacunae. Army by its very nature is ‘Manpower Centric’, whereas, Navy and AF are ‘Platform Centric’. Air Force and Navy cannot execute operations without weapon platforms, which costs exponentially higher than individuals who man these systems/ weapons. However, that is not the case in army. Infantry, the principal fighting arm, for example has its strength in bayonets. Thus, the man who wields the bayonet to take on the enemy, both in peace and war, should rightly be called as ‘Capital Asset’ rather than being part of ‘Revenue Expenditure’.

In addition to above, it is also highlighted that expecting a substantial increment in the defence budget (under Capital Head) may not be feasible unless the policy makers make an unexpected departure from the current thought process while allocating budget, which seems improbable. Therefore, the article will focus to carry out ‘Perception Management’ & also to suggest an alternate mechanism for calculating capital expenditure for Indian Army, thereby correcting the perceived imbalance between Revenue and Capital expenditure.

Revenue Expenditure of Indian Army[2]

Some of the statistics with respect to defence budget for the year 2018-19 are as under: –

| Revenue and Capital Expenditure of MoD.

|

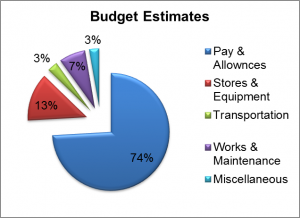

Breakdown of Revenue Expenditure of Defence Forces : 2018-19.

|

- Expenditure on Pay and Allowances.

Revenue Budget. The revenue budget of the defence forces has seen a modest increase in the past few years. However, the growth has been neutralised by the rising expenditure on the pay and allowances of the personnel. For the current year, 73.29% of the revenue allotment has been apportioned towards pay and allowances and balance for operations & maintenance. Amongst the services, Army being the largest service, accounts for bulk of the expenditure on this account and thus perceived to be responsible for imbalance in revenue and capital estimates of the defence budget. The same needs to be seen in light of the following:-

- Primacy of a Soldier in the Army. Unlike Air force and Navy which are platform centric services, the primary fighting machine of the army is the soldier. Recruitment and maintenance of so called ‘Human Machine’ is as important as any platform in the Air Force and Navy. Therefore, it would not be wrong if the cost incurred on pay of the soldiers, especially those belonging to the combat arms, is apportioned from the capital outlay. It would not only correct the imbalance between budget estimates between pay & allowance and operational maintenance cost but also reduce revenue expenditure substantially.

- Pay and Allowances. Currently 61% of revenue allotment is being spent on pay and allowance of Combatant/ non-combatant manpower of Indian Army as against 53% in Air Force and 29% in Navy[3]. It is only when the expenditure incurred on Auxiliary Forces, civilian manpower and Rashtriya Rifles which accounts for approx. 22%, is added to army’s account, that the expenditure rises exponentially.

- Sharing of Revenue Funds. Being the largest service, holding 85% of the manpower and proportionate requirement for operation and maintenance costs, allotment of higher share of funds to Indian Army is a necessity.

- Infrastructure Development. In case of Indian Army, development of infrastructure projects such as tunnels, roads, ammunition storage facilities etc are being undertaken using revenue funds, while in the Air Force works such as re-surfacing of airfields are accounted from capital budget.[4]

Budgetary Support to Border Security Force and Indian Coast Guard[5].

- The allocations to BSF and ICG under the capital and revenue head for the year 2016-17 were as under :-

| PMF | Capital | Revenue | Salary | |||

| Amount | % of Total Amount | Amount | % of Total Amount | Amount | % of Total Amount | |

| BSF | 857.00 | 05.49% | 14,746.75 | 94.50% | 12,376.03 | 84% |

| ICG | 2,468.97 | 58.19% | 1,773.25 | 41.80% | 790.29 | 44% |

- Like Army, major portion of allocation to BSF goes towards revenue expenditure with bulk of it being apportioned for salary. Army and BSF being primarily land forces have human resource as their capital while Navy and Coast Guard require platforms for their operation. Budgeting for defence forces, therefore should be viewed through the prism of operational requirements, nature of tasks and resources required to execute the task. Drawing comparison between Indian Army and Navy or Air Force, which have different roles and operational tasks is highly unjustified.

Nation’s Necessity of a Large Standing Army. The strength of the armed forces of the nation including the land, air and naval component is dependent on the envisaged security threats. India faces a multi-dimensional threat across the spectrum ranging from full scale conventional war to low intensity sub conventional operations. Large land frontiers, active borders and unabated internal security problems, necessitate maintenance of large land forces. Even advanced countries such US & UK, despite not facing a direct threat to their land borders or coastline and access to high end technologies, maintain a larger component of land forces as compared to air & naval component and consequently higher budgetary allocations[6].

Recommended Mechanism for Categorisation of Revenue and Capital Expenditure of Indian Army

Keeping in view the inescapable requirement of maintaining a large standing army and need for capital intensive expenditure on Air Force and Navy, the imbalance in revenue and capital outlays for IA is likely to stay. However, some of the measures mentioned below will help in better management of the available resources besides creating better perception regarding utilisation of revenue budget:-

- Restructuring of Budget. Human resource being the most critical component of IA, expenditure incurred on pay to Army personnel deployed on combat duties which is akin to payment of lease charges for acquisition of platforms in AF and Navy be appropriated out of capital budget. As per the current estimates pay and allowances of combat arms account for approximately Rs 50,000 cr out of total amount of Rs 80,900 cr earmarked for pay and allowances of IA. If the same is debited to capital, it would convert the imbalance to a large extent.

- Combat Manpower. Out of Rs 50,000 cr earmarked for pay and allowances of combat arms, even if 60% (personnel involved in actual combat) is apportioned out of capital budget, during active service, it will reduce the expenditure from revenue head substantially. Infantry soldier, who is the most flexible and versatile element on the combined arms battlefield should be considered as the primary weapon platform and hence expenditure incurred on his recruitment and equipping (ingredients of the basic platform) be catered for under the capital head.

- Re-appropriation of Expenditure. Expenditure incurred on Rashtriya Rifles and other auxiliary forces, being allocated to IA needs to be shifted either to capital head or be accounted for under a separate head as being done by UK, wherein expenditure on deployment overseas being covered under the head ‘War in Iraq’[7] or like Indian Coast Guard which is actually filling the operational gap of Indian Navy, but still has a separate head.

- Expenditure Incurred on Govt Organisation/ PSUs from Defence Budget. Presently 7% of the total Defence Budget is expended on Govt organisation/ PSUs like Ordnance Factories & DRDO, the same could be delinked from the Defence Budget and placed under ‘Research Grants’ separately as applicable to ISRO to boost the Capital Head required for modernisation of Indian Army.

- Provision for Operation and Maintenance under Capital Head. All major projects need to have life-cycle costs that should include operation and maintenance cost in addition to acquisition costs especially in case of missiles, smart ammunition, UAVs etc. This would help in reducing the revenue expenditure to a large extent.

Conclusion

The current ‘approach’ towards defence budgeting without awarding due weightage to India’s geostrategic threats and IA’s operational requirements emanating from a hegemonic China& radical Pakistan will only lead us to a troubled future. In order to counter the impending threats effectively, it is imperative that based on the economic growth and globally accepted parameters for defence spending, adequate resources are made available for modernisation and sustenance of Indian Army.

The outcry against increasing revenue expenditure, especially on account of ever increasing manpower costs is primarily due to lack of knowledge and understanding of complexities in which the army is operating. It must be appreciated that “War is Human Endeavour” and any weapon or technology without human interface will become partially or fully ineffective. That notwithstanding, restructuring of the budget by apportioning the expenditure incurred on payments to combat arms from the capital head will go a long way in correcting the skewed ratio between revenue and capital outlays, leading to better perception with respect to utilisation of funds by Indian Army.

References:

1. Standing Committee on Defence, MoD, Forty Fourth Report, Lok Sabha Sectt, New Delhi; March 2018.

2. Standing Committee on Defence, MoD, Forty Fourth Report, Lok Sabha Sectt, New Delhi; March 2018.

3. Defence Services Estimates, GoI, pp 2 & 3, 2018-19.

4. Standing Committee on Defence, MoD, Forty Fourth Report, Lok Sabha Sectt, New Delhi; March 2018.

5. Accounting at a Glance, Ministry of Home Affairs, 2016-17.

6. UK Defence in numbers, Sir Michael Fallon MP, September 2017.