Atmanirbharta, private industry participation in ammunition manufacture, corporatisation of the Ordnance factories, attempts of a long-term strategic partnership with vendors, steady reduction in imports, and significant increase in ammunition exports have indeed transformed the ammunition sourcing profile of the three services. The transformation, as regards to the Indian Army, is not only humongous in scope but has come in at an extremely fast pace, post many decades of reliance on just two sources – the Ordnance Factories Board (OFB) and imports. The OFB has already been consigned to history, and imports have witnessed a steady decline in recent years. These changes are undoubtedly welcome, and fill our hearts with pride as we see a shift from being ammunition importers to promising exporters. However, all transformative changes demand change management, a subject which has gained increasing relevance in the current times, particularly when the change is fast paced. It would also be important to underline the fact that change management is even more essential when the change is welcome and for the good, as it ensures conformity to the desired course/objectives and offsets complacency, if there is any.

The article is an attempt to bring to fore the broad contours of the transformation in the munitions landscape in India and highlight issues which demand attention as a part of the change management process. Appended below are some of the important initiatives taken by the Ministry of Defence and the Department of Military Affairs, followed by a discussion of their impact on the munitions landscape of the country.

- In 2017, the Govt approved the conclusion of long-term contracts for eight selected munitions through open tendering wherein Indian companies (with foreign equity not exceeding 49 percent) could participate [1]. This was the first time that the Indian army moved away from placing of indents of annual requirement on the OFB to seeking long term partnership with the Indian private industry.

- Year 2018 saw a revision of licensing norms with respect to the Defence sector and several components, parts, sub systems, testing equipment and production equipment were removed from the defence products list for the purpose of industrial licenses, so as to remove entry barriers for the private industry. A level playing field between the public and private sector was also created with regards to Exchange Rate Variations [2]. The total number of Defence licences issued increased from 215 as on 31st March, 2014 to 460 on 31st December, 2019; an increase of 275 companies [3].

- In July 2020, the Cabinet Committee on Security approved conversion of Ordnance Factories Board into 100% Government owned corporate entities, registered under the Companies Act 2013 [4].

- Draft ‘Defence Production & Export Promotion Policy (DPEPP)’ 2020 was placed in public domain as the Ministry of Defence’s overarching document to provide a focused and significant impetus to defence production capabilities with the twin aim of achieving self-reliance and enhancing defence exports [5]. The Defence Acquisition Procedure (DAP) 2020 was released in Sep 2020, which attempted to further ‘self reliance’ and bring in ‘ease of doing business’.

- By 2020, the industry was ably supported by a strong base of over 8,000 micro, small and medium enterprises that provided strength and vibrancy to the defence supply chain.

- In Oct 2021, seven new defence companies were established, including Munitions India Limited (MIL). The company controls the twelve Ordnance Factories engaged in the business of manufacturing ammunition and explosives [6].

- In Dec 2023, the Ministry of Defence signed a landmark long-term contract with Bharat Electronics Limited (BEL) for procurement of Electronic Fuzes for Indian Army for a period of 10 years at a total cost ₹ 5,336.25 crores [7].

- In March this year, the Directorate General of Quality Assurance (DG QA) has been re-orgainsed and realigned to the realities of the new corporatised defence Public Sector Undertakings. The change is a major reform towards ‘ease of doing business’, and also provides for a separate Directorate of Defence Testing and Evaluation Promotion to facilitate transparent allocation of Proof ranges and testing facilities to ammunition manufacturers [8].

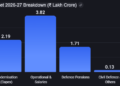

The next part of the article examines how the public and private munitions manufacturing landscape has been shaped by the above measures. The new corporate entity – MIL – is now running in its third year and has registered revenue from operations amounting to ₹ 7,126 crores in the financial year 2023-24, which is nearly 54 percent higher than the preceding financial year [9]. The revenue from export in 2023-24 stood at ₹ 1,726 crores which is nearly 24 percent of the total operating revenue [10]. In February this year, MIL has signed an export contract worth ₹ 225 million USD, an impressive feat by all accounts for the newly formed company [11]. MIL currently boasts of 95 percent indigenization, which undoubtedly is one of the highest in the entire defence sector in the country.

On the atmanirbharta front, the country has witnessed a positive shift – from release of ‘negative list of import’ to publication of ‘positive indigenization lists’. From August 2020 till October 2023, five positive indigenization lists have been issued for a range of 4,764 items. The government has also created the Defence Innovation Organisation (DIO) and an Innovations for Defence Excellence (iDEX) platform. A series of challenges – Defence India Startup Challenge (DISC) starting from DISC I in Aug 18 to DISC XI in Apr 24 have been thrown open to startups, and their response has been extremely encouraging. Both the indigenisation lists and the DISCs have endeavoured to include items/needs of the munitions inventory and that of MIL and Bharat Dynamics Limited.

Creditable also are the efforts of the private sector to design and produce state of the art, truly customised, and automated production lines for the manufacture of ammunition. The work done by Indian companies to create such production lines for the ammunition and for the AD Artillery fuzes at Ammunition Factory are indeed phenomenal. This endeavour is now being emulated by the budding private ammunition manufacturing industry. The very fact that the private sector is emulating the measures taken by the factories of MIL is the best proof of the positive impact of corporatisation.

The dramatic rise of private industry involved in manufacture of ammunition in the country vindicates the measures taken for establishing a level playing field and measures brought in for ‘ease of doing business’. Detailing the incredible success story of the private industry is beyond the scope of this article, and therefore it would suffice to say that munitions landscape has now moved away from the perpetual single vendor situation to participative and competitive tendering.

In the concluding part, we examine the implications of the changing ecosystem for the end users, and begin by looking at four important issues which relate to quality of the munitions inventory.

- Firstly, in the new ecosystem, the Director General of Quality Assurance’s (DGQA) responsibility with respect to the ammunition inventory is limited to Final Ammunition Inspection (FAI). In times ahead the warehousing agency will be much more exposed to the ammunition inventory than the quality managers. There will be thus an enhanced dependence on the ammunition technicians of the Army Ordnance Corps.

- Secondly, given the long life of ammunition inventory, it is essential that the suppliers and the ammunition warehousing agency have seamless exchange of quality related data contained in their respective enterprise systems. The factories of MIL have automated quality management systems monitoring their production. These systems store parameters recorded during various stages of production and testing. This data needs to be accessible to ammunition technicians of the Army Ordnance Corps, who are entrusted with the task of defect investigation. Similar bridges need to be built with the private industry in the interest of backward traceability, quality and ammunition safety. The budding private industry should also mandatorily invest in a state-of-the-art production and quality management enterprise system.

- Thirdly, the life extension methodology now needs to be a deliverable along with the physical delivery of munitions, both for the private and public sector suppliers. The Army Ordnance Corps needs to take this responsibility in entirety given the changed dynamics.

- Lastly, the vendors, both private and public, have deployed a host of modern technologies and processes for manufacturing and testing of their products. These technologies should automatically lead to superior deliverables with richer specifications in terms of safety and shelf life. It would be indeed a missed opportunity if the manufacturers deploy technologically superior and costlier methods only to stick to historic specifications for the end products.

Another important implication of the new sourcing ecosystem is the death of ‘indent’. The orders on the erstwhile OFB were placed through indents, which now is not possible. Each contract now needs to be preceded by a Request for Proposal (RFP) and the bid evaluation process. Can this elaborate process of concluding contracts match the pace at which the procuring agency used to place indents on the OFB? This can only be possible if procurers are empowered with streamlined procurement procedures that bring

in efficiency in terms of time and effort. In a similar vein, the producers, both public and private, need to be more responsive in responding to the RFPs and conclude contracts efficiently. It only needs to be seen that the year-on-year growth in operations revenue of MIL, quoted earlier in this article, is on what account? Is it because of old deemed contracts, or because of the robust exports, or on account of fresh contracts with the three services. The last stated reason is what is needed most for survival of the industry. Both the procurers and producers need to analyse this aspect. It would only suffice to surmise that when the entire ammunition sourcing landscape has moved ahead and transformed, the procurement processes can’t remain unchanged. The aforesaid is also vindicated by the limited success met by the long-term contracts attempted since 2017. Continuation of the legacy processes and procedures in the transformed ammunition sourcing ecosystem may not give the most optimal results.

Last but not the least, the ammunition landscape is moving from captive sourcing to participative and competitive tendering, which is indeed a welcome change. However, the competition need not be killing, and should remain healthy for all the participants so that the ammunition needs of the three services are met by a balanced mix of private and public enterprises. The Indian army certainly needs both.

[1] Ministry of Defence. (2017, Dec 20). Manufacturing of Ammunition for Indian Army by Indian Industry. Press Information Bureau.

[2] Ministry of Defence. (2018, Feb 05). Manufacture of Ammunition by Private Sector. Press Information Bureau.

[3] Ministry of Defence. (2020, Mar 16). Efforts to Boost Defence Sector. Press Information Bureau.

[4] Ministry of Defence. (2020, Sep 19). Corporatisation of OFB. Press Information Bureau.

[5] Ministry of Defence. (2021, Mar 22). New Defence Production Policy. Press Information Bureau.

[6] Ministry of Defence. (2021, Oct 15). Seven new defence companies carved out of OFB, dedicated to the Nation on the occasion of Vijayadashmi. Press Information Bureau.

[7] Ministry of Defence. (2023, Dec 15). Atmanirbharta in Ammunition Manufacturing. Press Information Bureau.

[8] Ministry of Defence. (2024, Mar 28). Department of Defence Production issues notification for

re-organisation of DGQA. Press Information Bureau.

[9] @IndiaMunitions. (2024, Apr 01). Munitions India Ltd (MIL) registers revenue from operations of Rs. 7126 Crores (Provisional & Unaudited) for financial year 2023-2024. Retrieved from https://x.com/IndiaMunitions/status/1774767955986751686

[10] @IndiaMunitions. (2024, Apr 01). Munitions India Ltd (MIL) registers revenue from operations of Rs. 7126 Crores (Provisional & Unaudited) for financial year 2023-2024. Retrieved from https://x.com/IndiaMunitions/status/1774767955986751686

[11] @IndiaMunitions. (2024, Feb 06). MIL signed a contract worth 225 Million USD for supply of Artillery ammunition to Kingdom of Saudi Arabia. Retrieved from https://x.com/IndiaMunitions/status/ 1754888205902532619